2020 infrastructure financial adviser rankings

As inspiratia examines the performance of financial advisers in the global infrastructure market in 2020, the results reveal that M&A transactions took centre stage

With a cumulative total of US$34.7 billion (£25.4bn €28.9bn) allocated towards infrastructure transactions in 2020, the financial adviser which tops inspiratia's rankings is Morgan Stanley.

The financial adviser's most prominent deal was its participation in the US$14.3 billion (£11bn €12.bn) Zayo Group acquisition.

Zayo is the biggest independent fibre provider in the U.S. and controls a fibre network of over 130,000 miles in North America and Europe. Digital Colony Partners and EQT, through its fourth infrastructure fund, acquired the company in March [2020].

Morgan Stanley and Deutsche Bank served as financial advisers to the buyers. Goldman Sachs and JP Morgan advised the seller Zayo for the acquisition.

Top 10 financial advisers by transaction volume, 2020

Source: inspiratia | datalive

Goldman Sachs surges into second place with an annual transaction volume of US$23 billion (£16.9bn €19.1bn).

One of the most notable deals in the company's diverse offering was its advisory to the US$5.95 billion (£4.6bn €5.1bn) iQ Student Accommodation acquisition.

Private equity investor Blackstone acquired iQ Student Accommodation – which owns a portfolio of 28,000 beds across the UK – from Goldman Sachs Merchant Banking Division and biomedical research charity, Wellcome Trust.

Goldman Sachs, Morgan Stanley and Eastdil Secured acted as financial advisers to the seller. The Bank of America and Citigroup gave financial advice to Blackstone.

BDO follows third having offered financial advice on US$20.2billion (£14.8bn €16.8bn) worth of finalised contracts in 2020.

Notably, the model audit specialist assisted Total for the financing of the US$20 billion (£15bn €16.9bn) Rovuma LNG project in Mozambique.

The project reached financial close last September [2020] and will involve the development of the Golfinho and Atum natural gas fields in the Offshore Area 1 concession, and the construction of a two-train liquefaction plant with a capacity of 13.12 million tonnes per annum.

Deal count

When the league tables are analysed based on the number of finalised contracts in 2020, DC Advisory and Macquarie Capital claim the top position with 18 deals each.

Top financial advisers by deal count, 2020

Source: inspiratia | datalive

DC Advisory mostly focused its activity on the transport and telecoms sectors.

Notably, the adviser participated in the 4.8% stake acquisition of Japanese network technology company NEC Corporation.

The deal saw Japan's Nippon Telegraph and Telephone Corporation buying a minority stake in NEC Corporation for US$599 million (£480m €530m. The two companies are planning to work together to develop 5G wireless technology.

DC Advisory gave financial advice to NEC Corporation for the deal that closed in June [2020].

Macquarie Capital's heftiest deal in 2020 was the US$1.9 billion (£1.5bn €1.7bn) AirTrunk acquisition.

Macquarie Capital joined KPMG to provide financial assistance to the buyer Macquarie Infrastructure and Real Assets (MIRA), who purchased an 88% stake in the Sydney-based hyperscale data centre company AirTrunk, from Goldman Sachs, TPG and the company's founder Robin Khuda

The sellers were advised by Goldman Sachs, Grant Samuel and PwC.

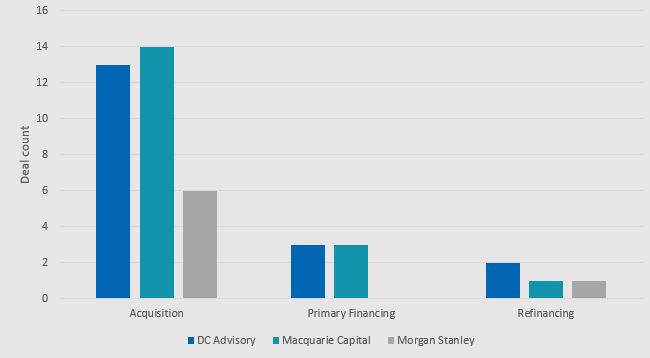

When we break down the deal count for the top three financial advisers – DC Advisory, Macquarie Capital and Morgan Stanley – by financing type, we notice that all three advisers had a strong focus on secondary transactions.

Notably, Macquarie Capital provided in-house financial assistance to MIRA during its sale of waste management provider WCA Waste Corporation.

WCA Waste Corporation owns 37 collection and hauling operations, 27 transfer stations, 22 landfills and three material recovery facilities across 11 U.S. states. The company was sold to GFL Environmental for US$1.2 billion (£940m €1bn) in October [2020].

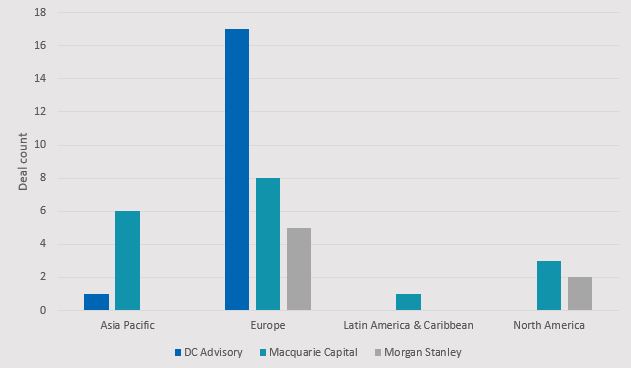

When we take a look at the deal count for the top three financial advisory firms by region, we notice that the majority of the deals took place in Europe.

DC Advisory's largest deal in the region was the US$3.5 billion (£2.6bn €3bn) Brisa Auto-Estrada de Portugal acquisition.

The deal involved Arcus Infrastructure and co-owner José de Mello Group selling an 81.1% equity interest in Brisa Auto-Estrada de Portugal – a 1,500km network of highway in Portugal – to a buyer consortium comprising Dutch pension manager APG, National Pension Services Korea and Swiss insurance company SwissLife.

DC Advisory and Deutsche Bank served as financial advisers to the buyer consortium, Morgan Stanley and Millenium Investing Banking gave financial assistance to the sellers.

Q4 Focus

When focusing on advisory performance during last year's final quarter, Rothschild emerges as the leading financial adviser.

The adviser's quarterly total of US$2.16 billion (£1.6bn €1.8bn) is made up of two acquisitions.

Notably, Rothschild offered financial advice to the Abu Dhabi Retirement, Pension and Benefits Fund and Abu Dhabi Development Holding Company on their 20% stake acquisition of Abu Dhabi National Oil Company (ADNOC) Gas Pipelines for US$2.1 billion (£1.6bn €1.8bn).

ADNOC Gas Pipelines is a subsidiary of ADNOC with lease rights to 38 gas pipelines covering a total of 982km.

Top 10 infrastructure financial advisers by deal count and transaction volume, Q4 2020

Source: inspiratia | datalive

DC Advisory was the leading adviser in the quarter in terms of deal count, with eight finalised deals under its belt.

The financial adviser's most prominent deal from the period in question was the US$1.3 billion (£1bn €1.09bn) expansion of the full fibre broadband service provider G.Network.

Cube Infrastructure backed G.Network, received an equity investment of US$390 million (£295m €322m) from the pension fund Universities Superannuation Scheme (USS), and an additional US$985m (£745m €813m) in debt from four lenders in December [2020]. USS received financial advice from DC Advisory for the deal.

G.Network will use the money to roll out its open access network over the next five years, connecting around 1.4 million premises across London after digging up 4,500km of streets.